This portfolio is a mess (and that's a good thing)

Real diversification looks messy. Don't panic.

Dr. Richard Smith

February 27th, 2023

Blog | This portfolio is a mess (and that's a good thing)

tl;dr

A diverse portfolio is a healthy portfolio

A bunch of diversified growth paths looks super messy

Those messy lines can add up to one smooth, reliable growth path

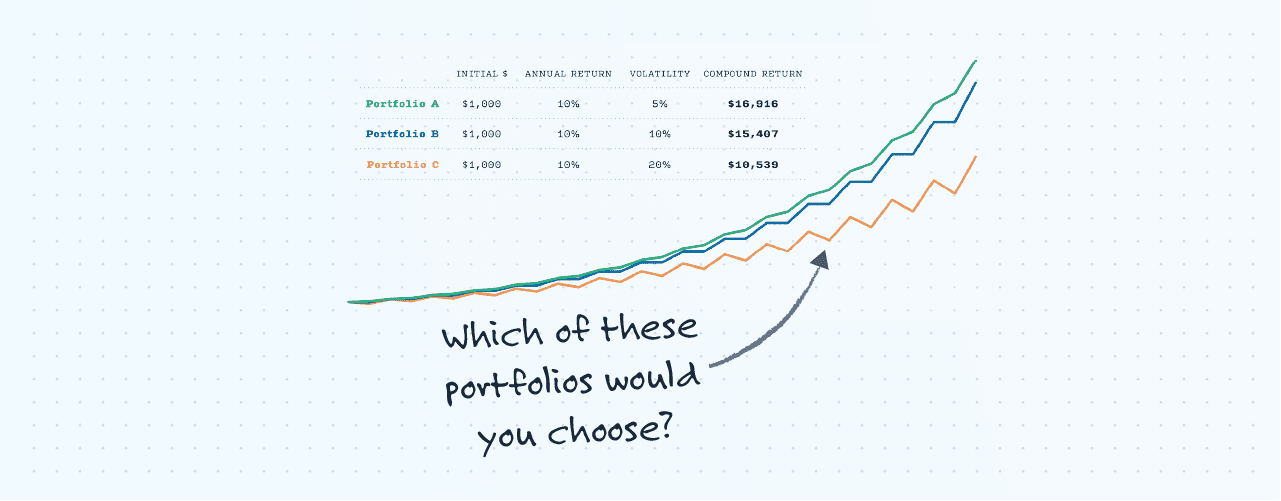

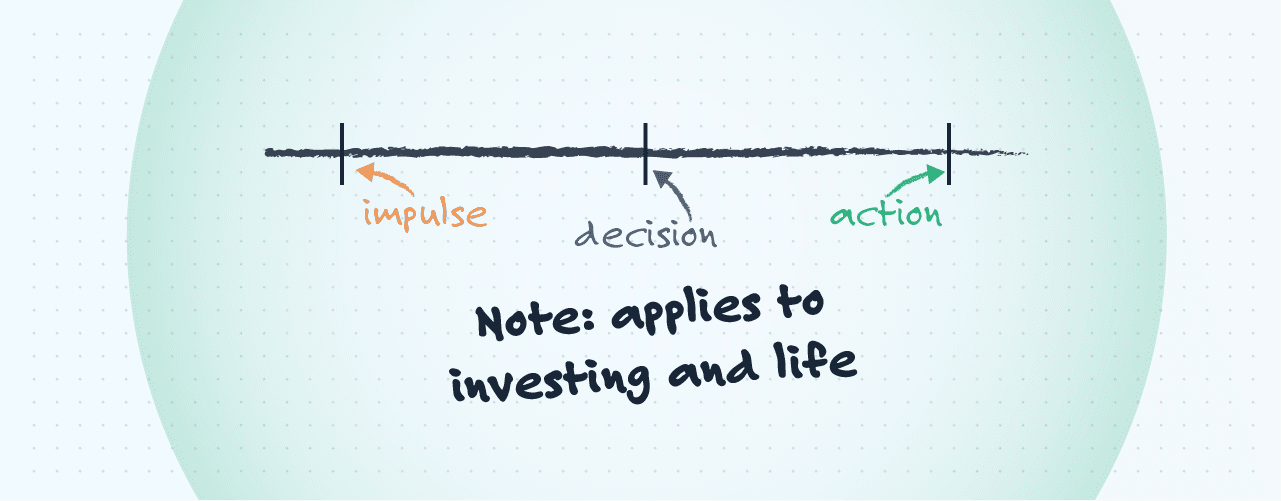

Every asset in the markets goes up and down on a day-to-day basis, and we call that volatility. Same goes for the market as a whole. Some are highly volatile, some less so.

Some volatility is necessary. Without it, our investments literally wouldn’t grow. But there are a few huge drawbacks to high volatility:

It’s stressful. If your portfolio is way up or down, you're probably losing sleep.

It kills your profits in the long run. Because of the way compound interest works, a more volatile portfolio returns less, all else being equal.

Diversification is simple, in theory: it’s the practice of combining assets in a way that reduces volatility.

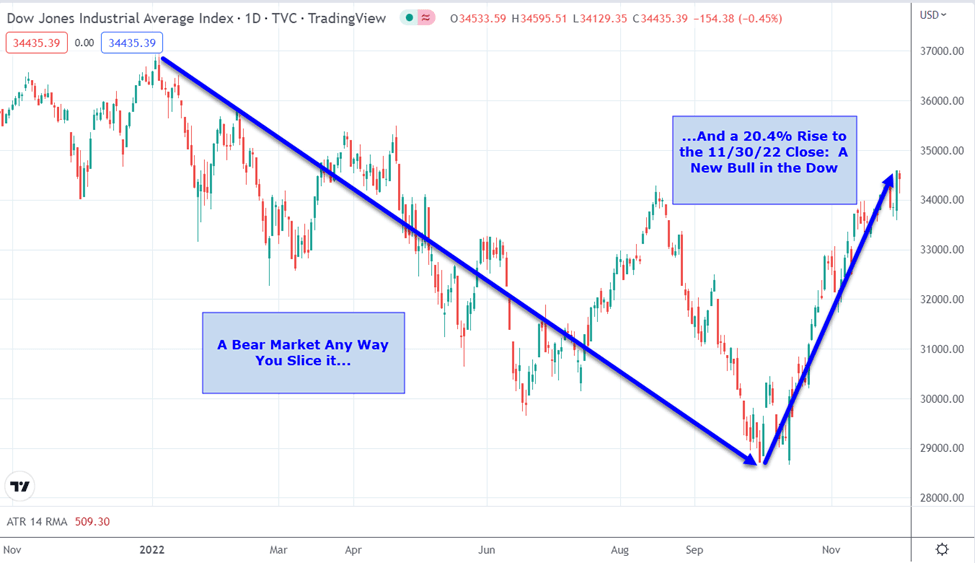

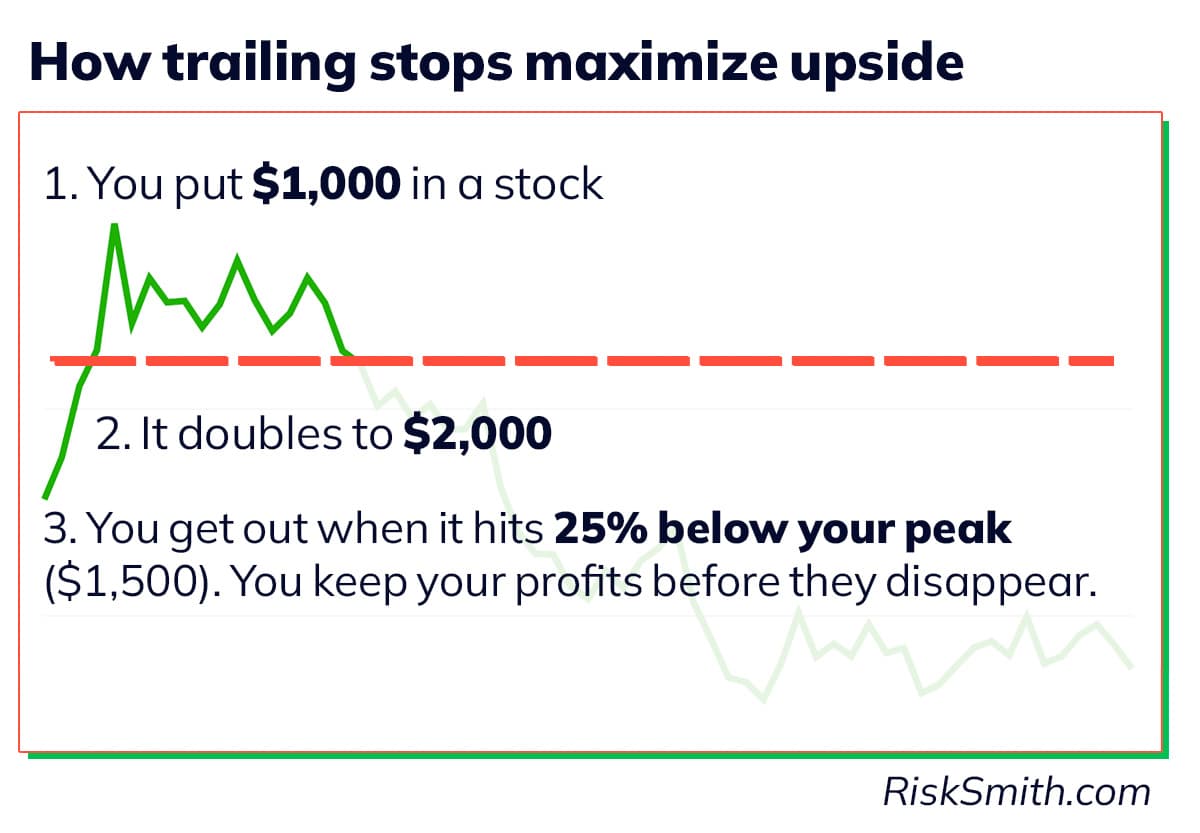

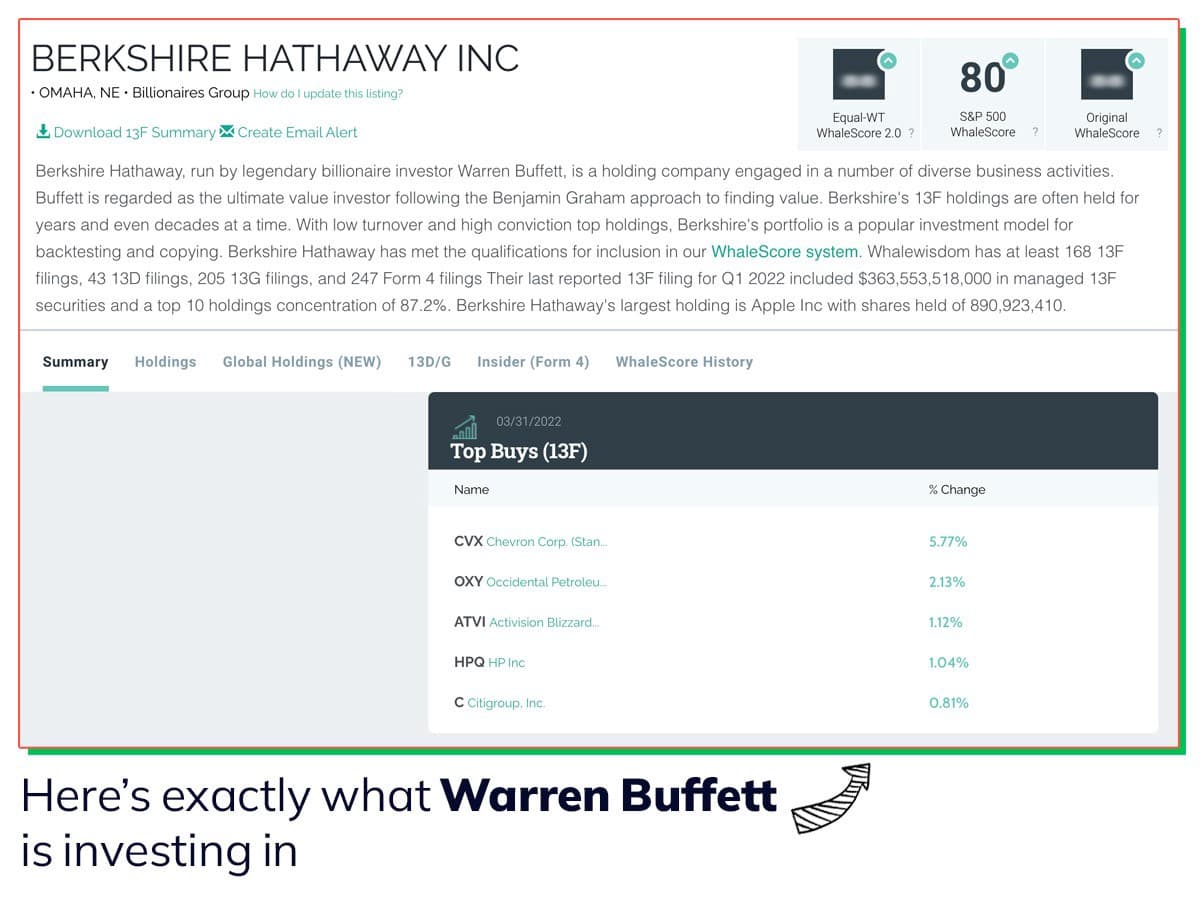

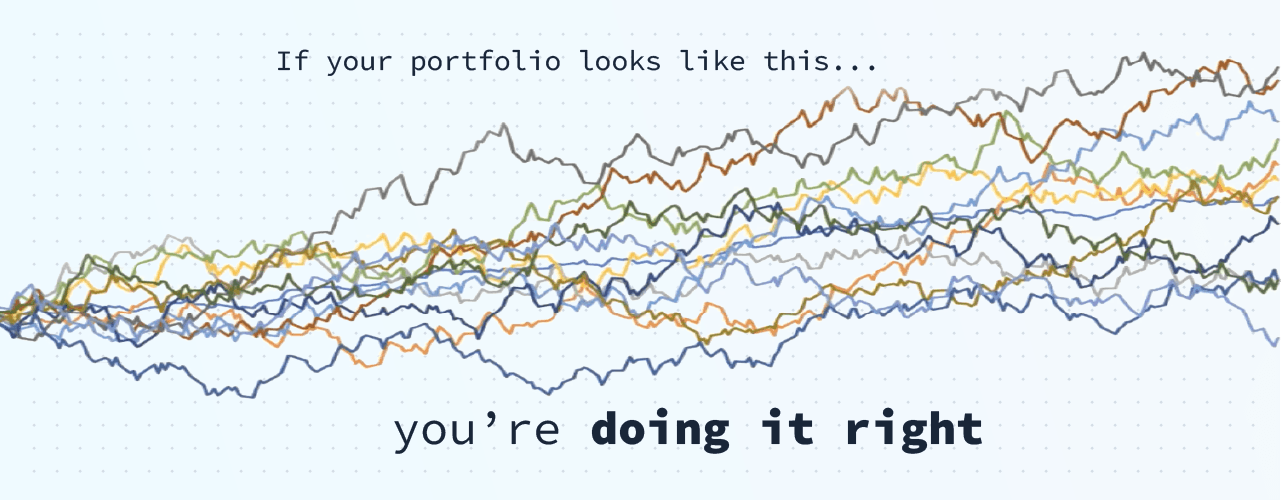

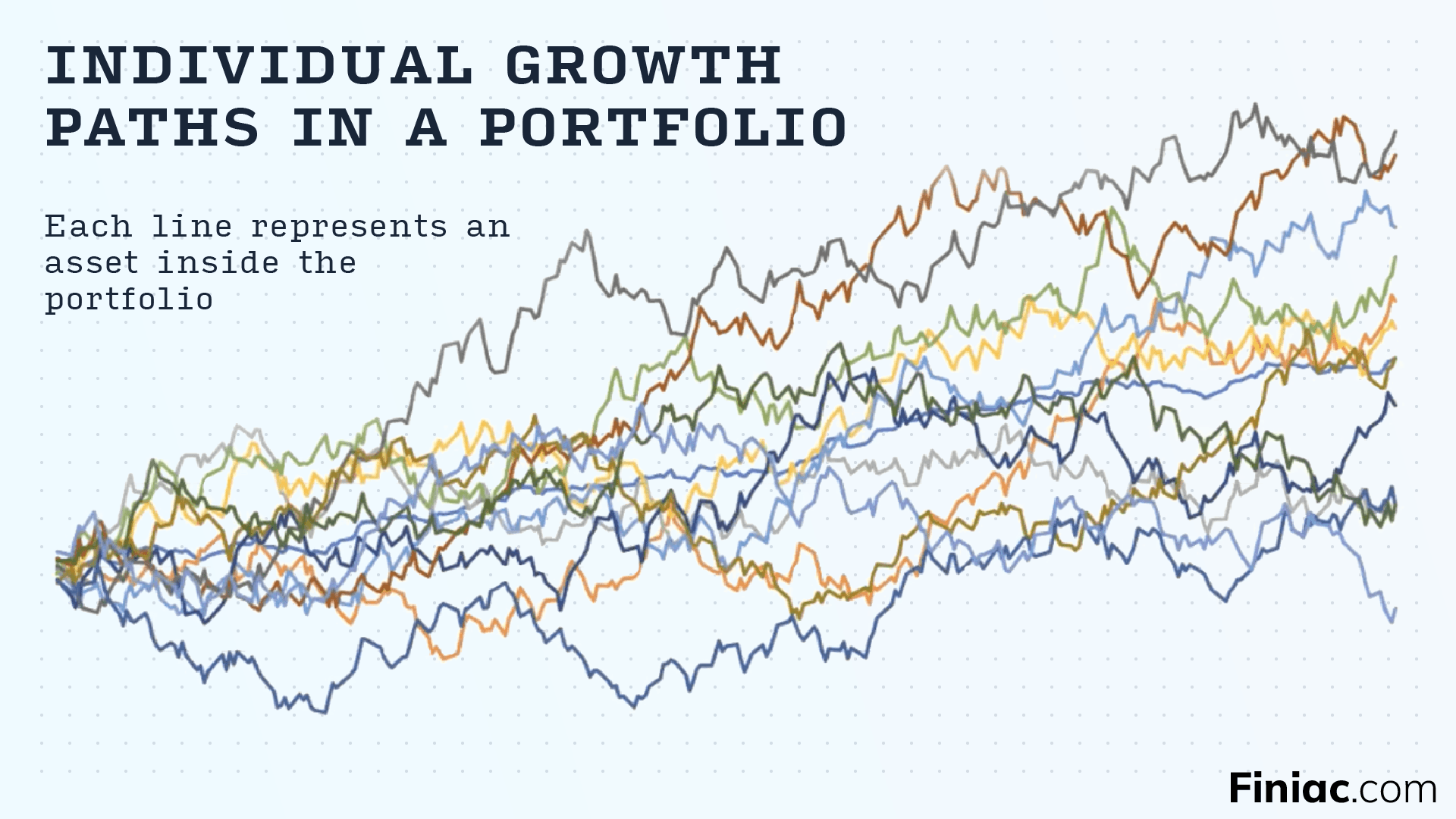

Take a look at this portfolio:

It’s a mess, right? It’s like a tangle of Christmas lights. You look at this and think, “There can’t possibly be any order in here.”

But weirdly enough, this is actually a really clean, well-balanced portfolio underneath it all.

When your portfolio growth looks like that, it's a really good thing.

Because:

It’s got 12 stocks (a manageable number)

Almost all of them are growing (this chart shows one year)

They don’t all go in one direction at the same time

That last one in is the key.

Each of these 12 investments is pretty independent of the others. A price jump up or down on any given day doesn’t imply that any of the others will do the same.

That’s all that diversification is, in the end. It’s making sure that each of your assets moves on its own, not in tandem with the others.

When I say the portfolio itself is a good one, here’s what I mean:

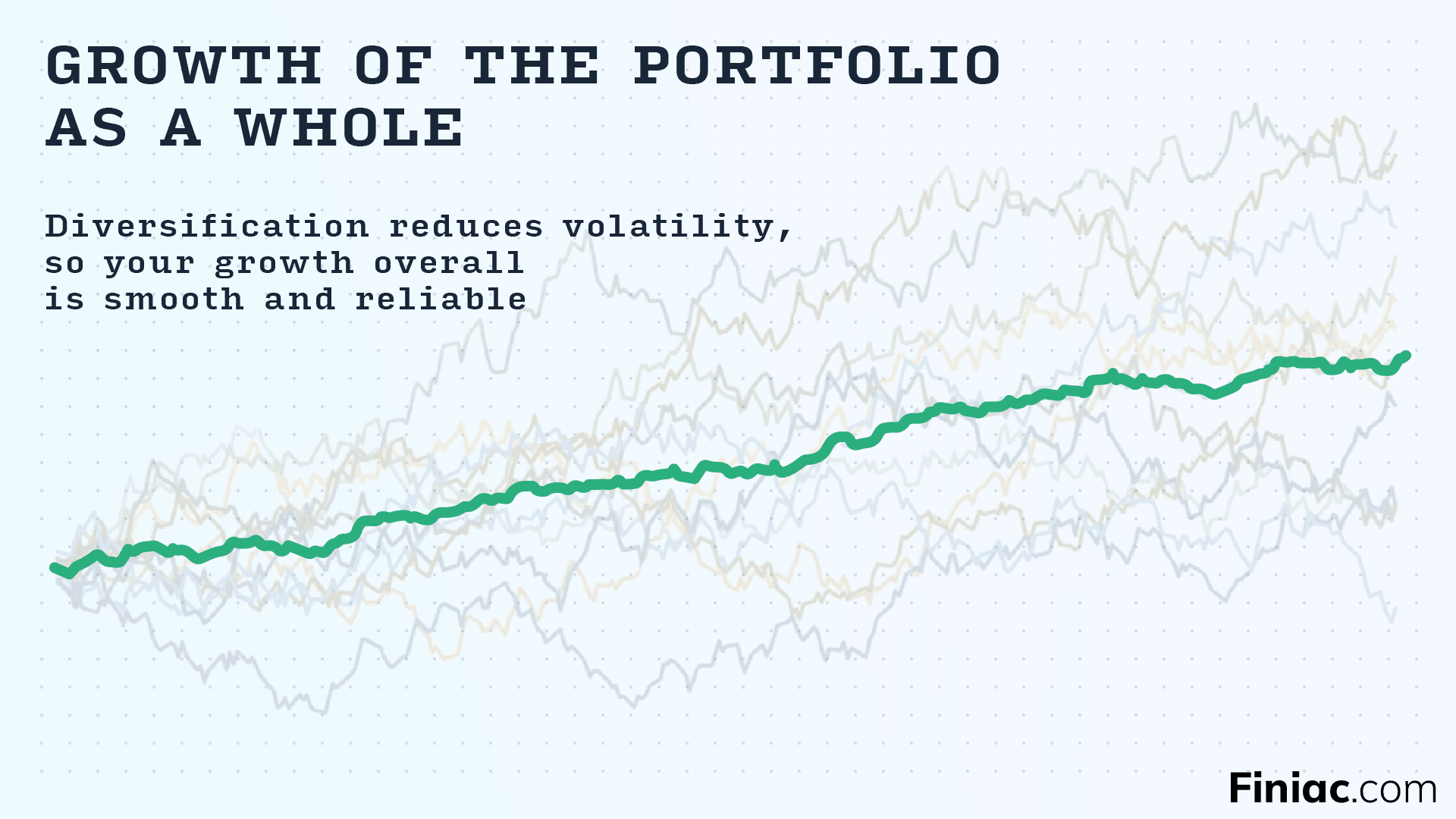

Buried underneath all that mess is a remarkably smooth, up-and-to-the-right growth line.

We’ve taken a bunch of jumpy, in some cases pretty risky assets and—because they’re uncorrelated—we were able to combine them into one reliable, solid return stream.

This is most important logical leap for investors: to jump from thinking about one asset at a time, to instead think about the portfolio as a whole.

When you make that move, you’re automatically ahead of most investors out there.

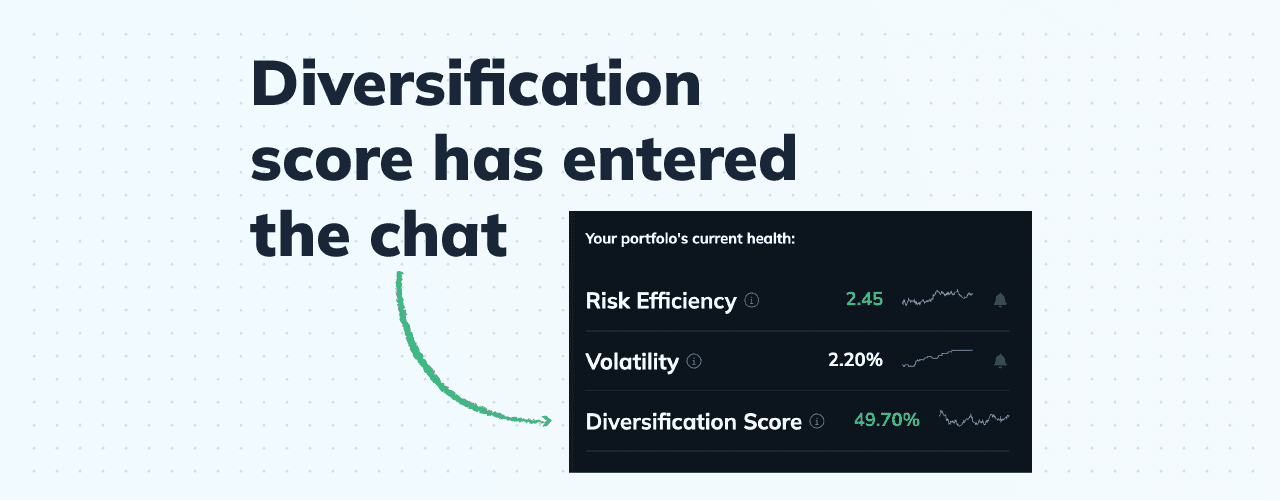

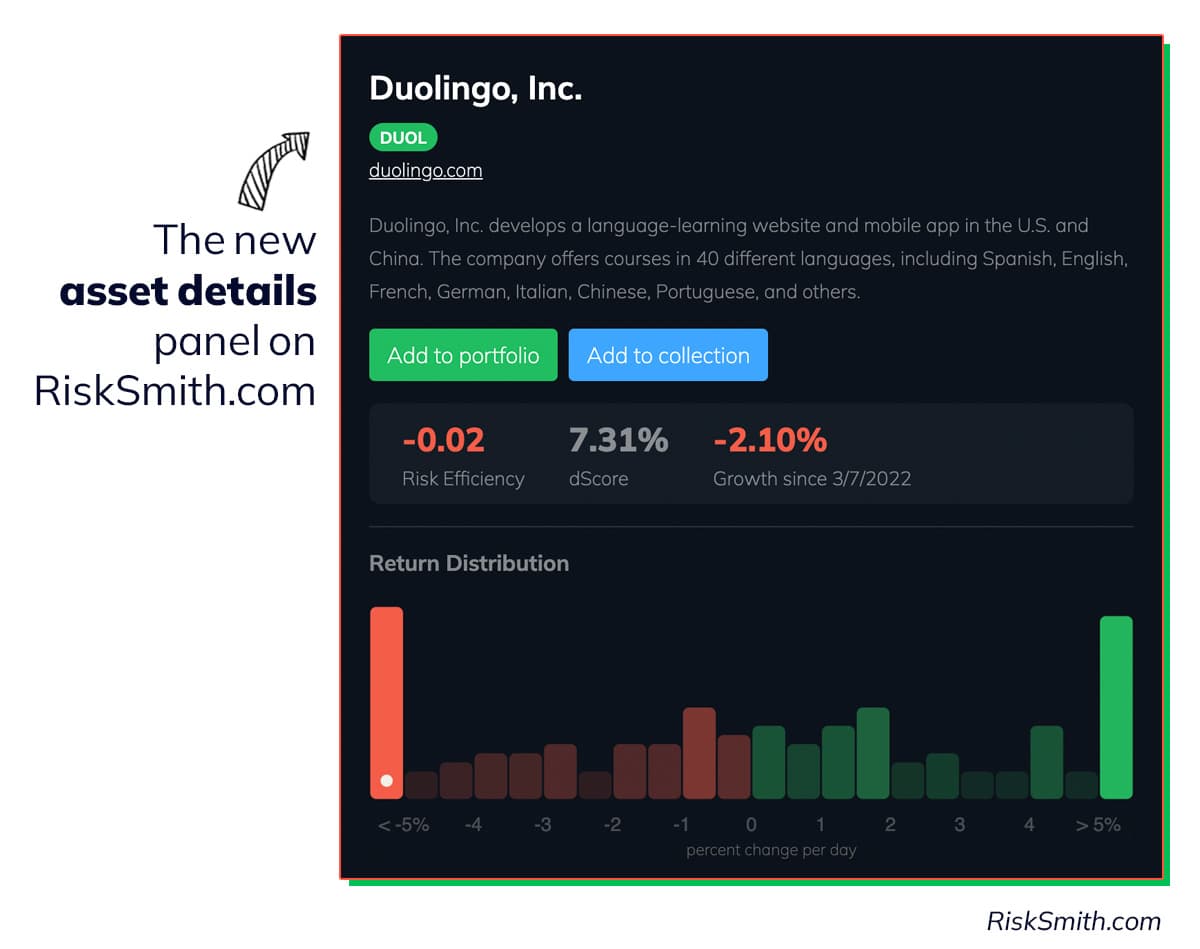

So that’s where you want to end up. Our new Diversification Score is exactly how to get there.

Choose assets that up your DS, and you’re headed toward a portfolio with a smooth growth path like the one above.

Don't fall prey to loss aversion

Design better portfolios with RiskSmith

Related Posts