Debunking Myths About Women + Investing

Let's stop lying about gender differences in investing.

Dr. Richard Smith

March 20th, 2023

Blog | Debunking Myths About Women + Investing

tl;dr

Women are NOT more risk averse than men.

Men are NOT better investors than women.

Women are NOT less confident investors than men.

Ever since Abigail Adams – wife of one president and mother of another – helped build her family’s fortunes with some savvy investing, women have been debunking myths about their investing acumen. Let’s carry on the debunking tradition.

Myth #1: Women are more risk averse than men.

By investing significantly in the very risky government and war bonds of a budding nation, Adams clearly had no problem with risk. Adams aside, it’s a widely held belief that women are more risk averse than men. Is it true?

A study by the German Institute for Economic Research questions these assumptions and the research by controlling for self-perceived willingness to take risks. It’s true that more men invest in risky assets. But men and women who invest in risky assets, or who say they are willing to, are equally comfortable with risk.

Like Adams, Nancy Zevenbergen, founder of Zevenbergen Capital Investments, isn’t buying into any myths about women being more risk averse than men.

She invests in companies that she believes will change how the world works and does business. She was an early investor in Tesla and discovered Shopify, and, early on, she made big bets on Netflix, Amazon, and Facebook that paid off.

In 2015, she launched two mutual funds: the Zevenbergen Genea Fund and the Zevenbergen Growth Fund, which boast respective 10.96% and 7.98% annualized returns since inception.

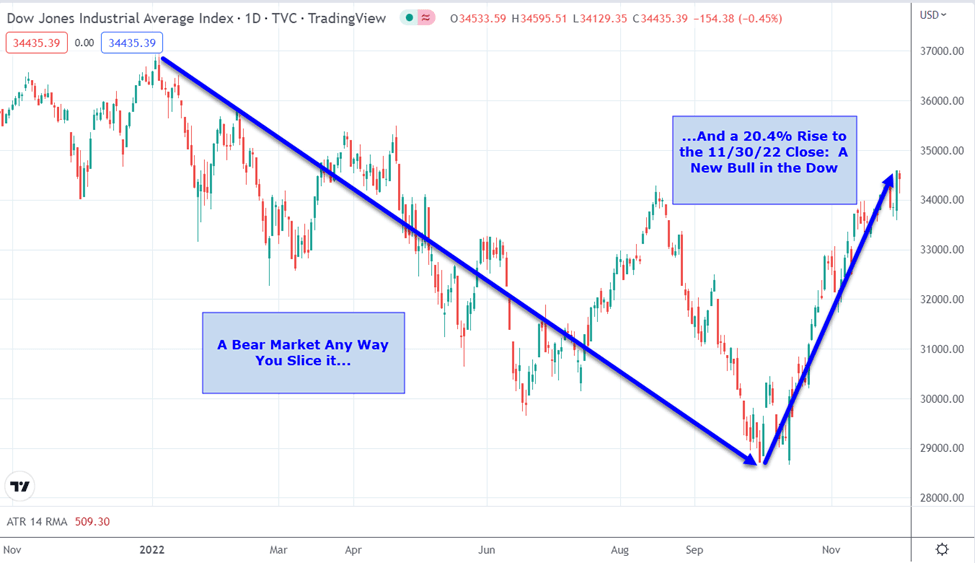

Like many investors, 2022 was rocky for Zevenbergen. Because of the big risks she has taken, she has seen some big bumps. Clearly, she isn’t uncomfortable with risk.

Myth #2: Men are better investors than women.

Nearly a century after Adams, Victoria Woodhull and her sister Tennessee Claflin opened a brokerage firm on Wall Street and became the first women stockbrokers. They swiftly dispensed of any notion that men are better investors when they made a fortune for their mostly female clientele and Cornelius Vanderbilt.

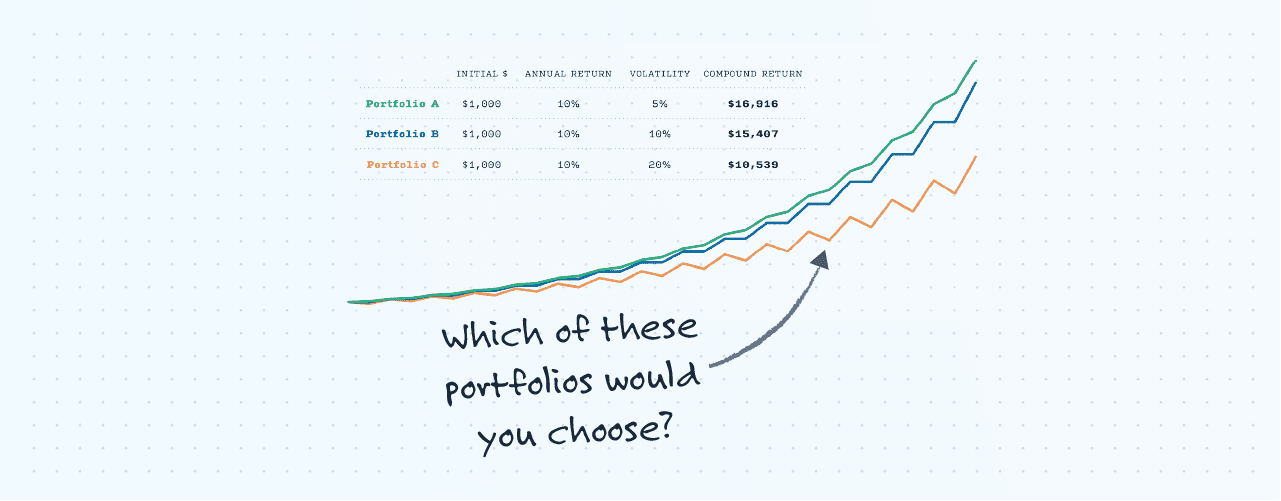

Only 9% of women think they are better investors than men. But according to research, women may actually be better. In a study of 35,000 brokerage accounts by UC Berkeley (my alma mater), women generated returns of about one percentage point more per year than men. (That may sound small, but it adds up.)

A widely reported 2017 Fidelity report showed women's portfolios performed better than men's by 40 basis points, or 0.4%. And a 2019 Goldman Sachs research note found that women and men were comparable in their returns and the amount of risk they take.

The Hedge Fund Journal has been publishing the 50 Leading Women in Hedge Funds since 2009. When asked if it gets harder to find new names every year, the answer is no. They have found that firms are increasingly promoting women into major roles. In their 2022 report, 49 of the 50 women were new to the report, and 11 new firms were represented.

Myth #3: Women are less confident investors than men.

Though it wasn’t a problem for Hetty Green, a wealthy 19th-century investor who made her husband sign a prenup, it’s regularly reported that women are less confident about investing than their male counterparts.

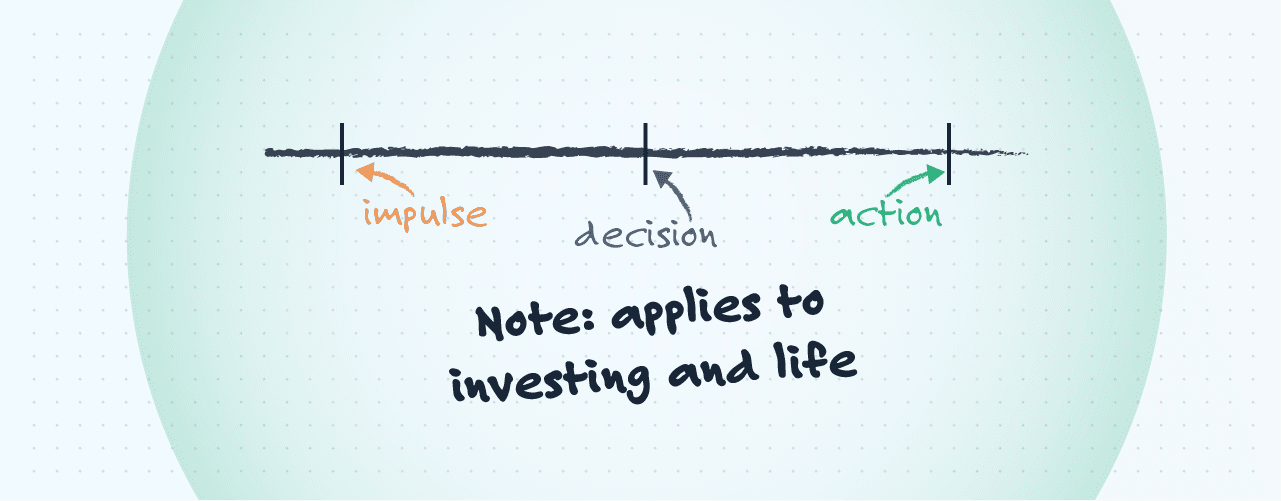

Typically, this is framed as an obstacle women must overcome, but in fact it’s exactly the opposite. Overconfidence is a weakness that men must overcome.

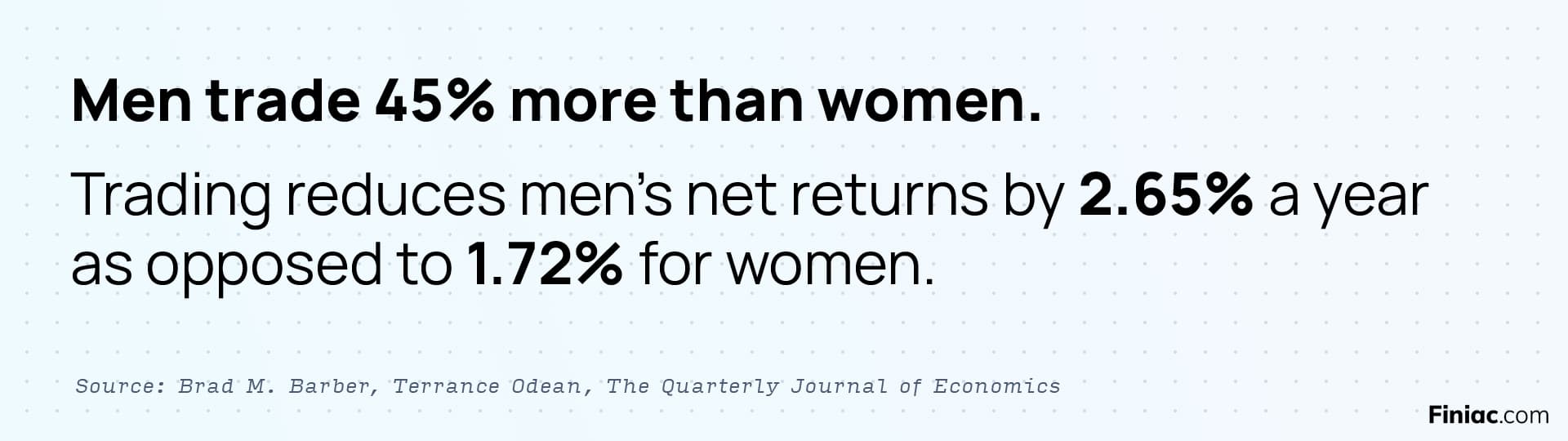

UC Berkeley faculty Brad M. Barber and Terrance Odean pointed this out way back in 1998 in their seminal paper Boys Will Be Boys: Gender, Overconfidence, and Common Stock Investment. One striking conclusion: “Single men trade 67% more than single women and earn annual risk-adjusted net returns that are 2.3% less than those earned by single women.”

Robinhood reported, “Almost half of the women we surveyed haven’t invested because they don’t know where to start. Similarly, 43% of women haven’t invested because they think they don’t understand the stock market.”

That’s not ignorance. It’s intelligence! ALL novice investors don’t know where to start and don’t understand the stock market. Admitting this is a strength, not a deficiency.

Acknowledging what they don’t know has, no doubt, contributed to women’s success. According to this Forbes article, “Female investing success in 2020 extends well beyond soaring growth stocks. Women-run funds are leading the way in everything from small cap stocks, to emerging market debt portfolios, dividend paying companies, and sustainable investments.”

Truth #1: Myths aren’t stopping women.

Women are letting go of these myths, whether their male counterparts care or not. Rather than trying to fit into the male-dominated culture of investing, women are creating their own culture.

Launched in 2014, Ellevest (“Built by women, for women”) addresses some of the reasons why the current culture is not attractive to women. The company provides more workshops, coaching, and investing options and acknowledges and addresses pay and expense gaps, career breaks, and life span. Established brokerage firms wanting to attract more women investors are following suit.

In honor of Women’s History Month, take a look at who you turn to for investing insights and advice. Is it heavily tipped toward men? Maybe it’s time to find out why women are getting such good results.

Follow some amazing women investors. They are not hard to find. Veronica Dagher interviews women from all aspects of finance and investing on her podcast Secrets of Wealthy Women. And check out this list of 6 All-Star Women Investors who are changing the culture, making a difference, and making a fortune.

Fight the noise,

Dr. Richard Smith

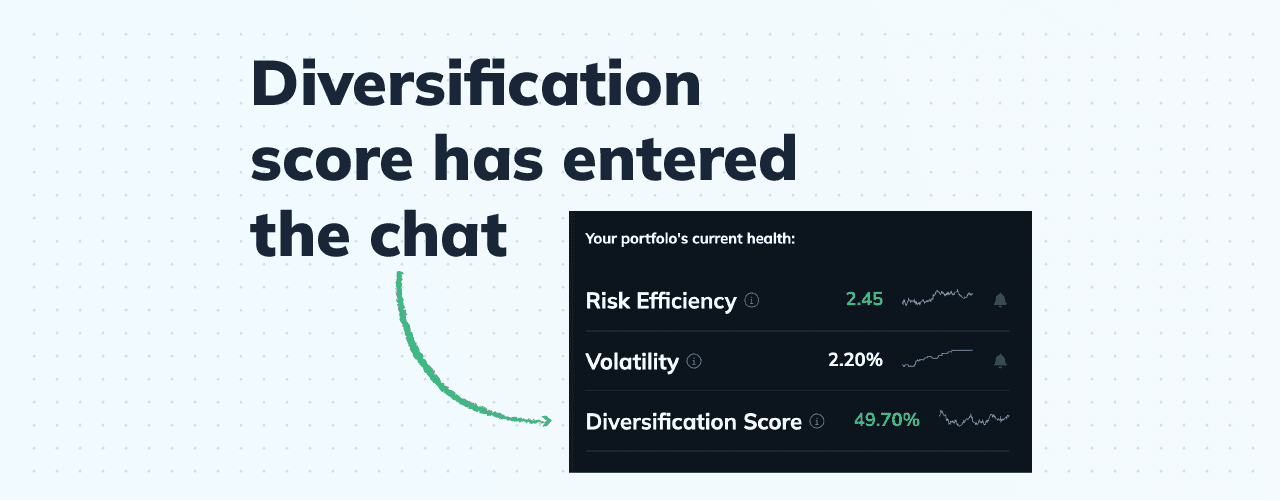

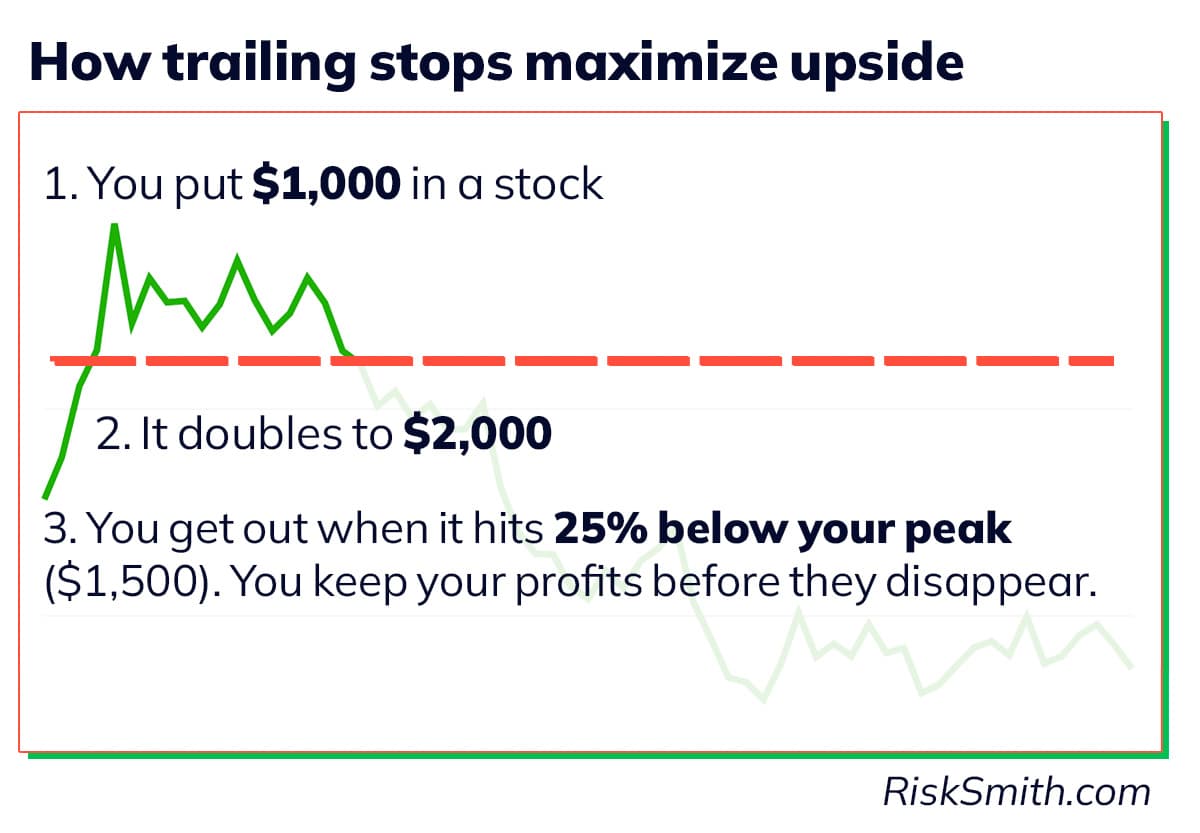

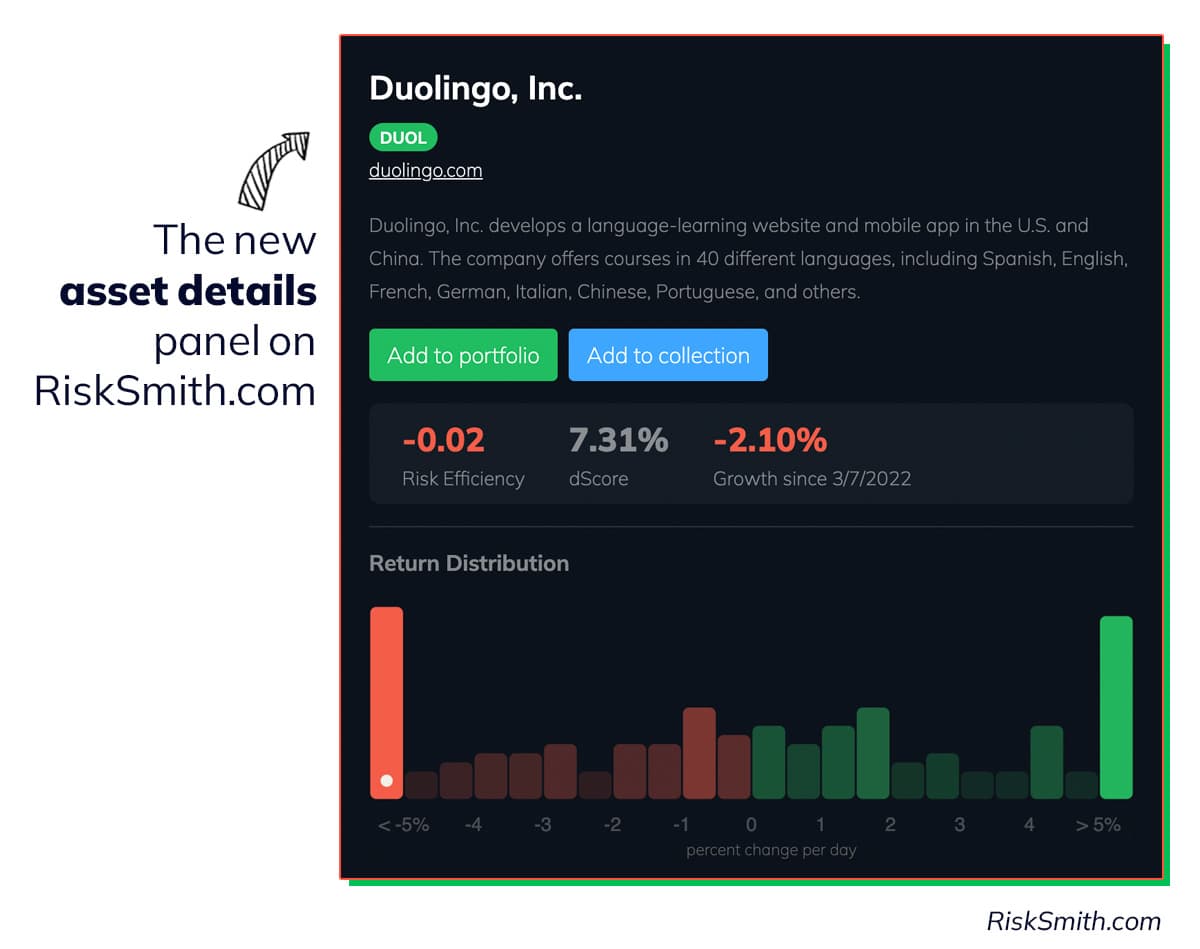

Don't fall prey to loss aversion

Design better portfolios with RiskSmith

Related Posts