3 Lessons from Warren Buffett's Annual Letter

We're not asking you to love the Oracle of Omaha. We promise.

Dan Muse

March 27th, 2023

Blog | 3 Lessons from Warren Buffett's Annual Letter

tl;dr

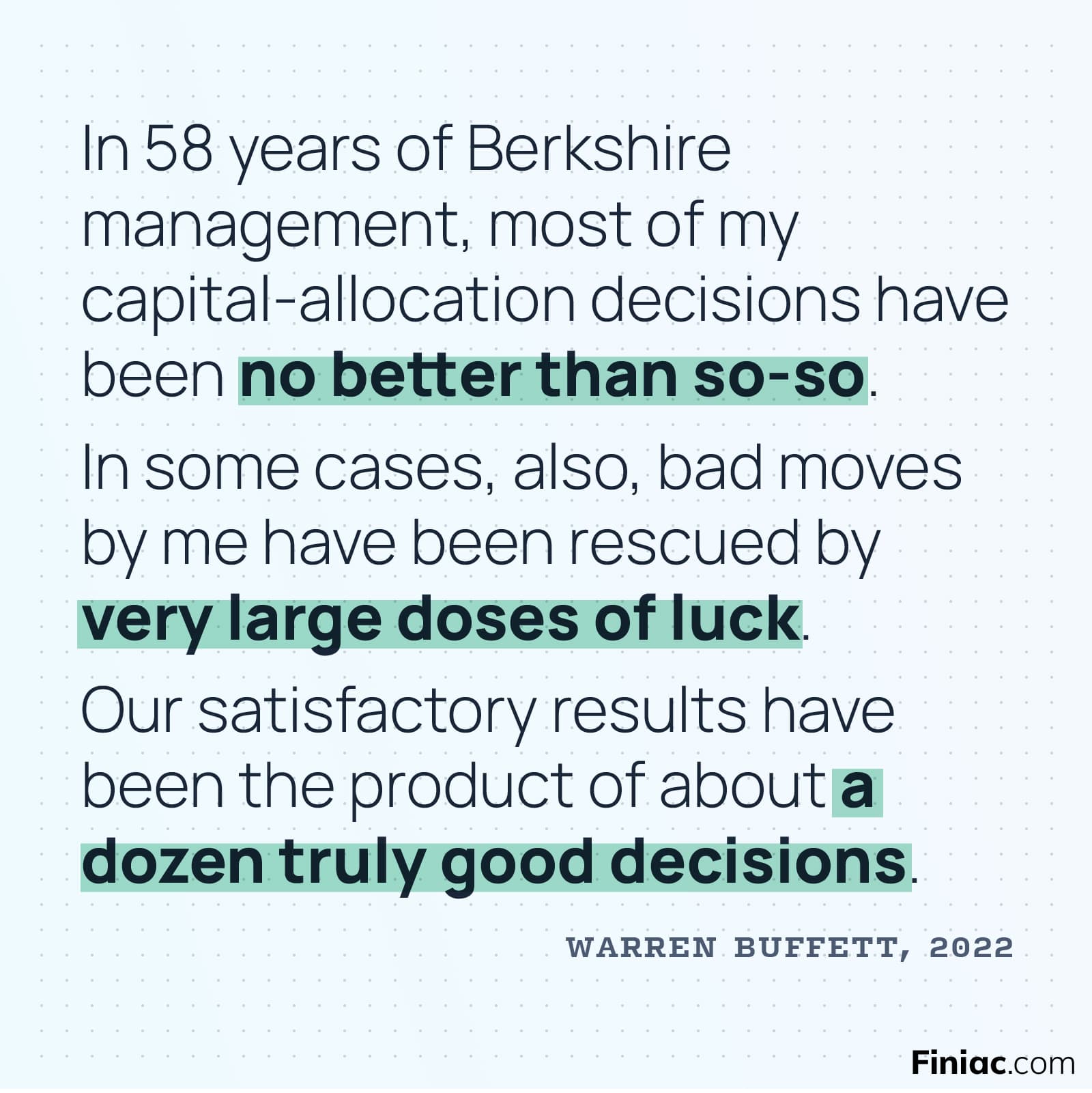

You're gonna make mistakes.

Luck plays a big part.

A few good decisions can save you.

If you don't stray from those truths, you're already ahead of the game.

Big caveat before we dive in:

We’re not asking you feel any type of way about Warren Buffett.

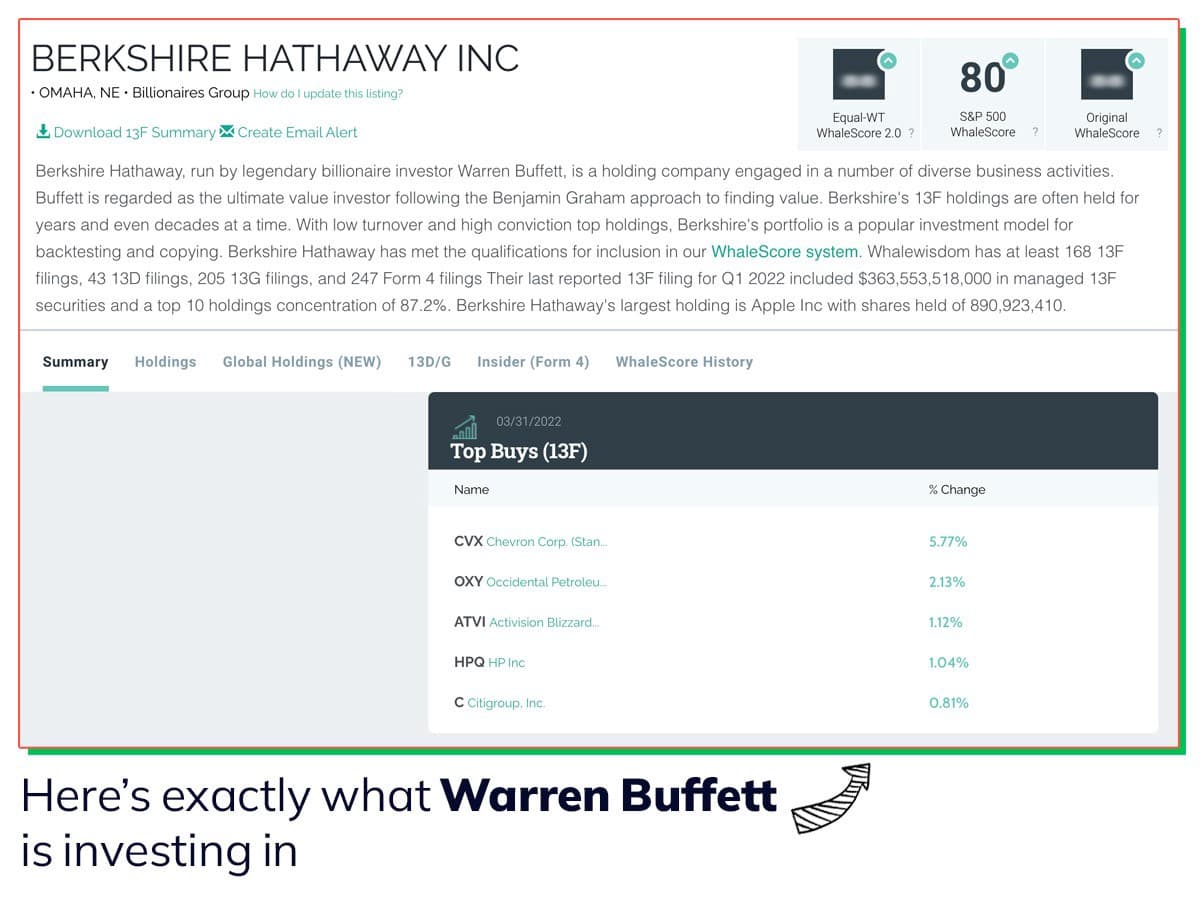

He’s a billionaire. A lot of his acolytes go way too far with the whole “Oracle of Omaha” rhetoric. The decisions he makes for the hedge fund he runs aren’t necessarily going to be the right ones for you individually.

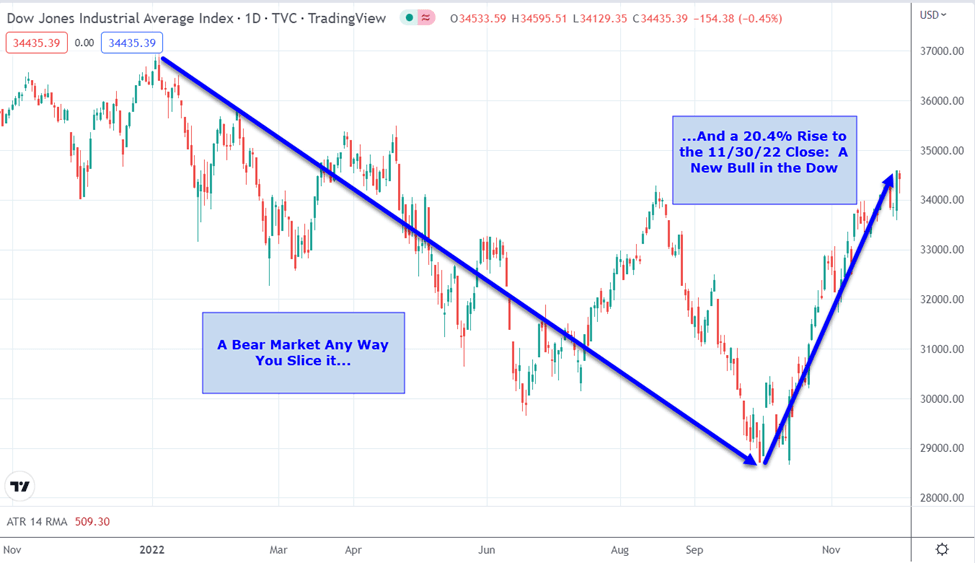

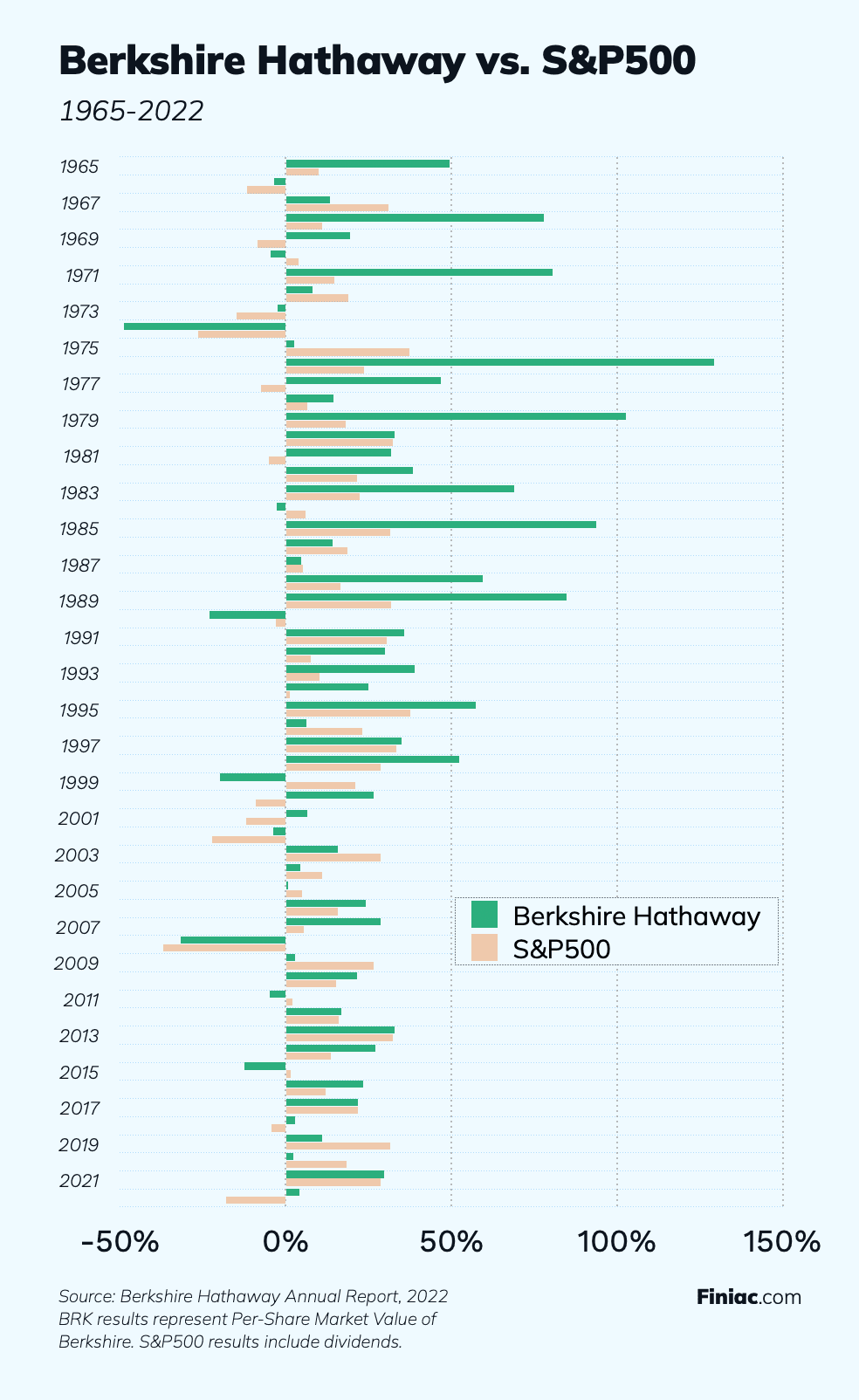

But his results are pretty undeniable (see the graph below). And we salute his impeccable fashion sense.

Here are 3 big lessons from his annual message that are worth taking to heart.

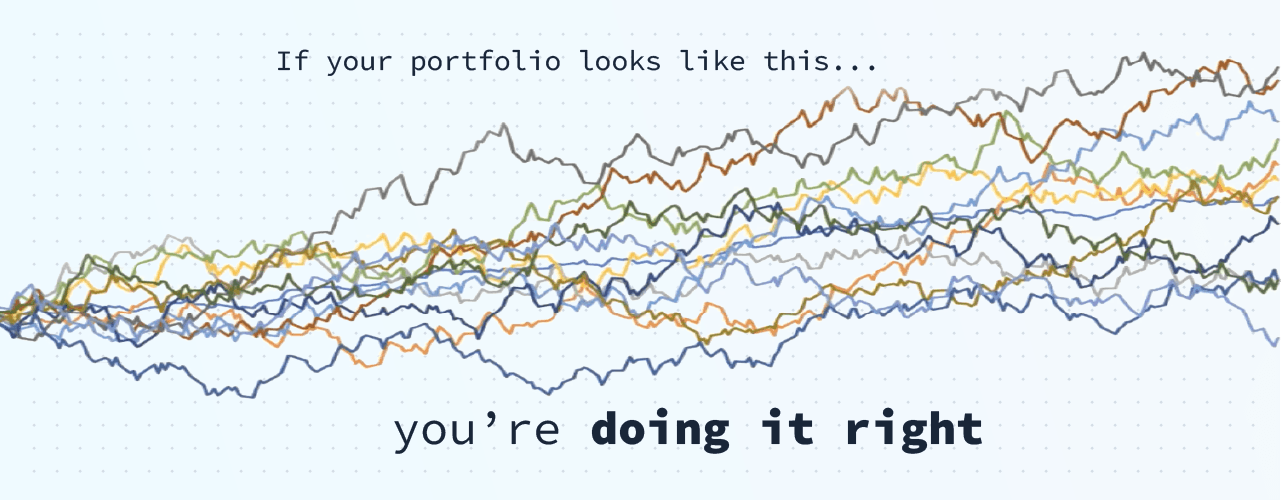

Investing is mostly mistakes. It’s like that old truism about baseball: if you only make contact in 3 out of 10 at-bats, you’re doing truly great. This stuff is hard.

When you open that brokerage app, be ready to see that you’re down once in a while. That doesn’t mean you’re messing up, or that everything is going haywire. It’s not a referendum on your worthiness as an investor. It’s just the reality of having money out in the markets.

And we’ll go one further: mistakes are vital.

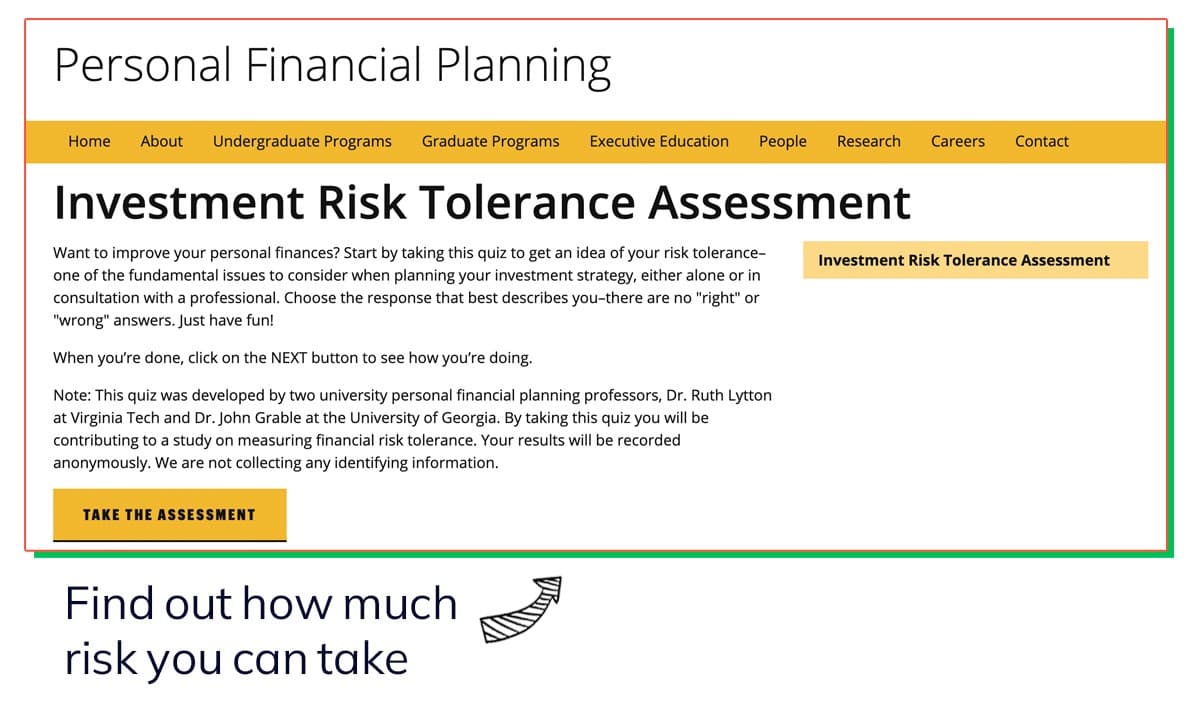

If you’re not making mistakes, then you’re still well inside your comfort zone. Which means you’re probably not taking quite enough risk.

That’s the trick: when you find your perfect level of risk tolerance, right there at the edge of your comfort zone, you’ll be making good mistakes. And, hopefully, learning from them.

You don’t know the future. Finiac certainly doesn’t know the future. All we can do is look at the past and make some educated guesses.

So when you take a win as an investor, give yourself a pat on the back for making a good bet, but don’t get start believing that it’s all you.

There’s plenty of luck in every win:

Maybe the company’s main competitor announced a quarterly downturn.

Maybe their CEO scored a friendly write-up in Fast Company magazine.

Maybe

To be honest, none of that is your acumen paying off. It’s just luck. It could have gone the other way. Some other day, it will.

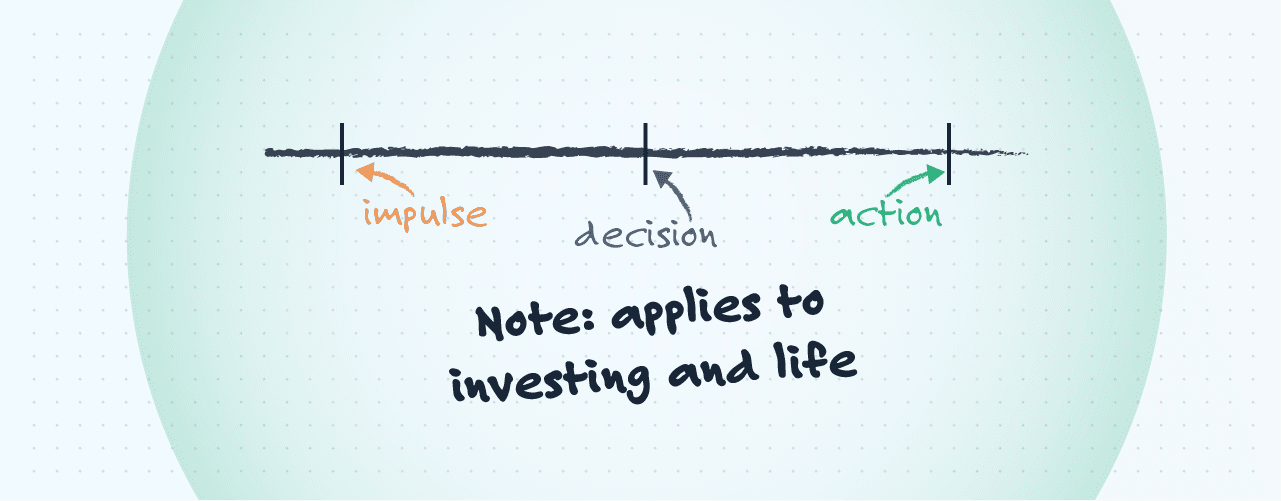

That being said, you’re still in the driver’s seat here. Skill plays a part. Meaning:

Now we’re getting to our sweet spot—the part where Finiac can actually help you.

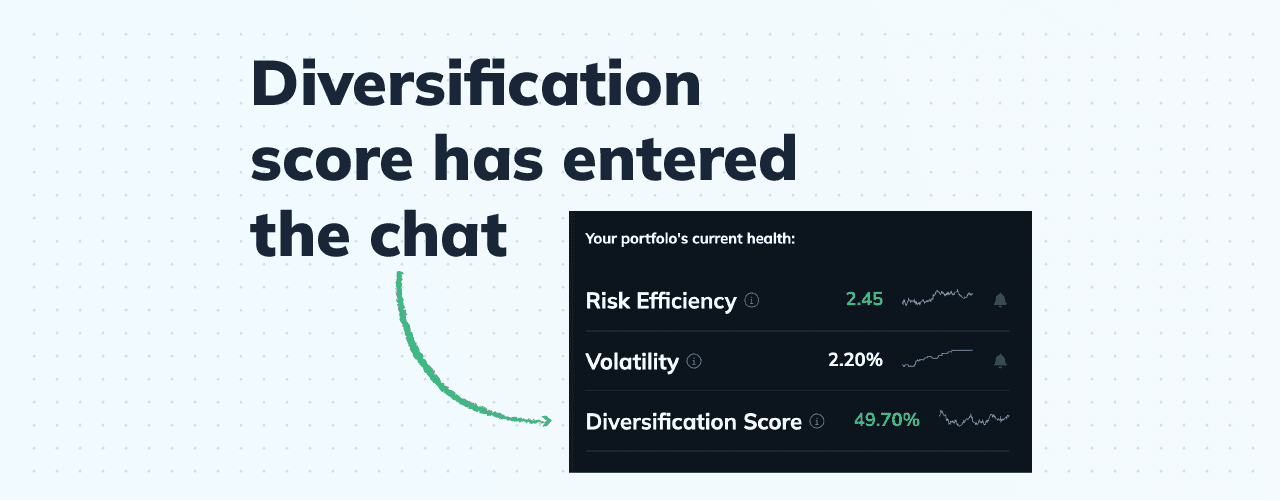

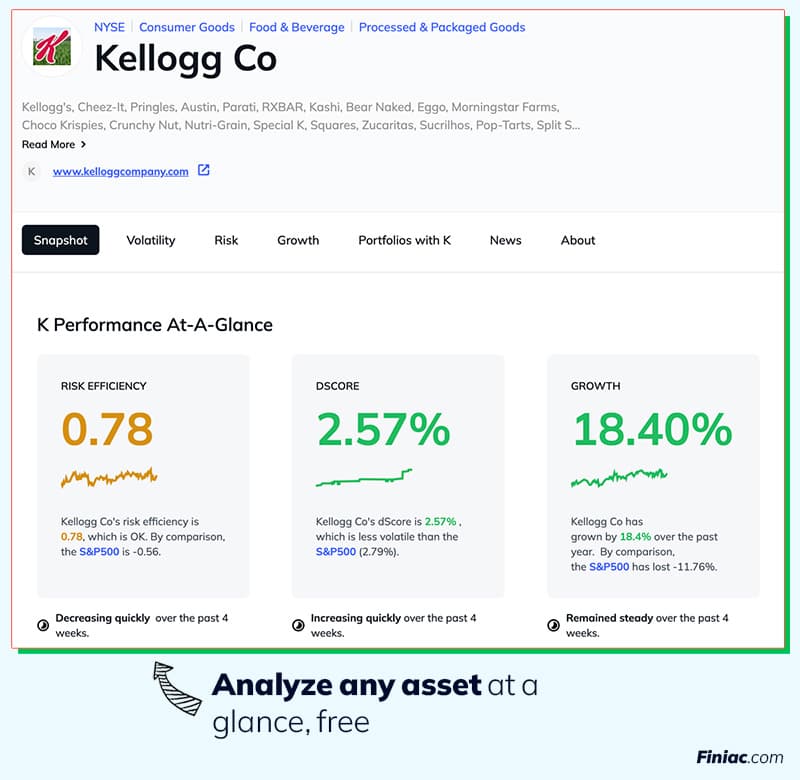

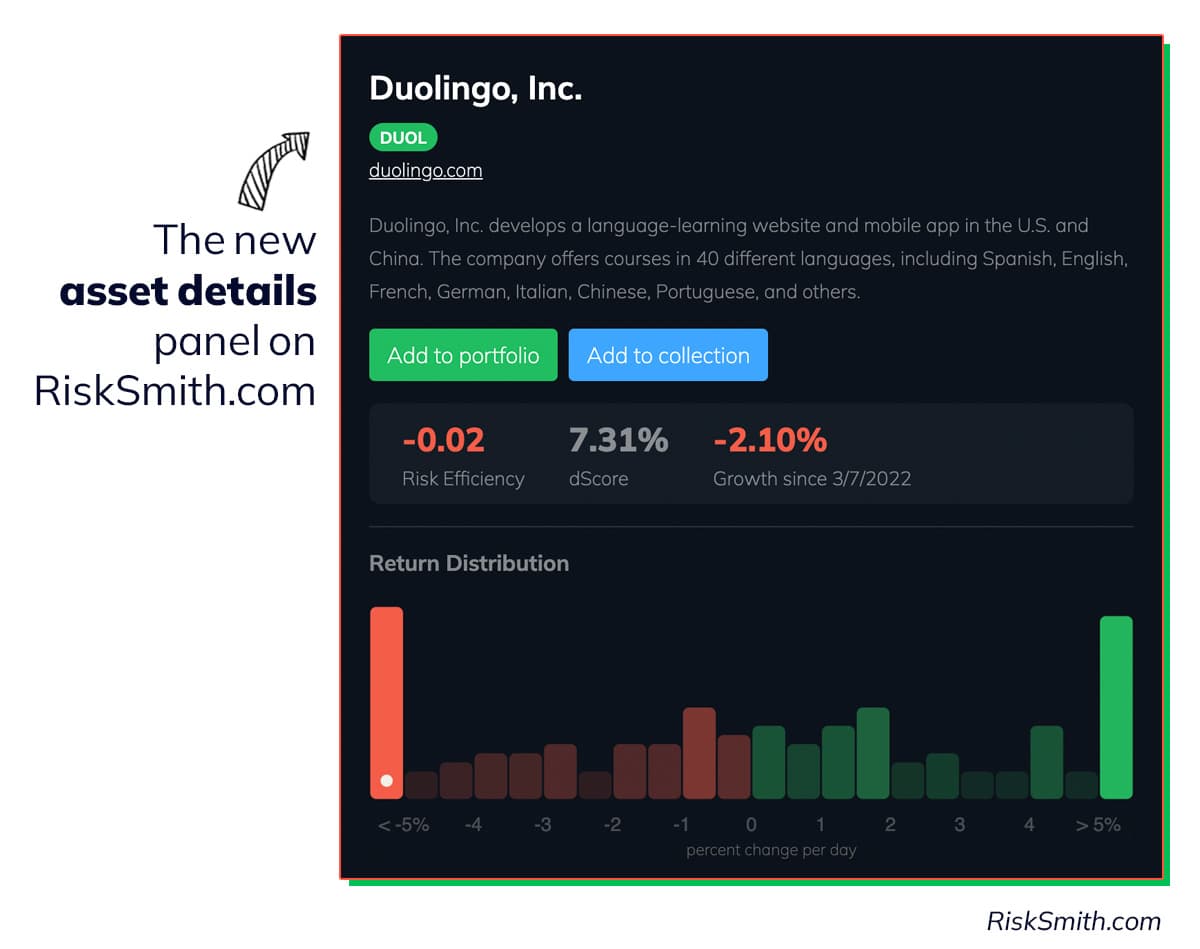

The metrics that Finiac provides help you make those few good decisions that mitigate your mistakes and lean into your luck.

Take Diversification Score, for instance. It tells you how much gain you’re getting from creating a healthy mix of low-correlation assets in your portfolio.

If you make the decision to keep your diversification score high—and commit to it—then you’re setting yourself up for better long-term performance, particularly in a market downturn.

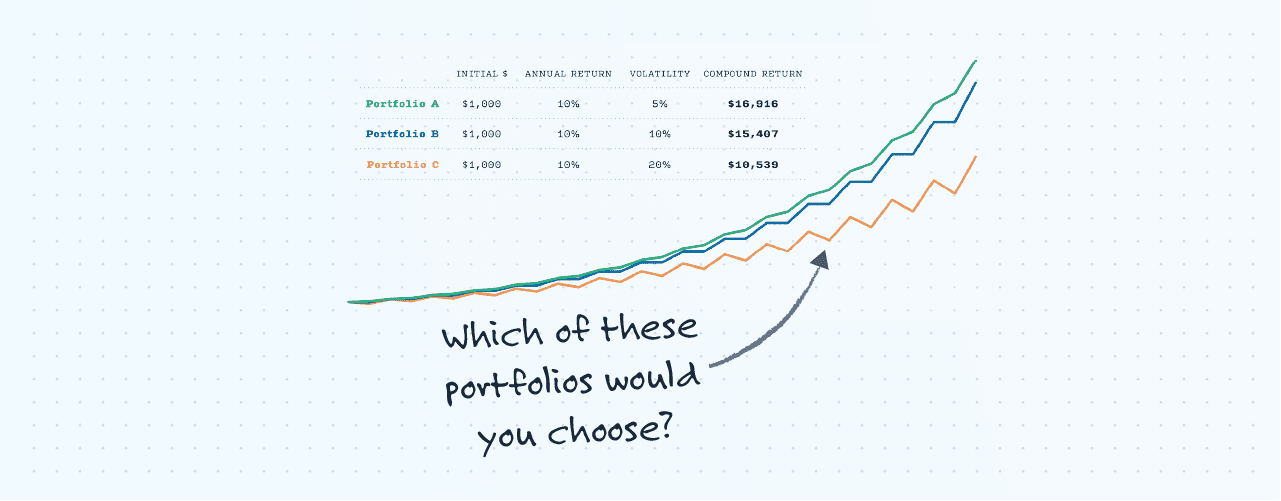

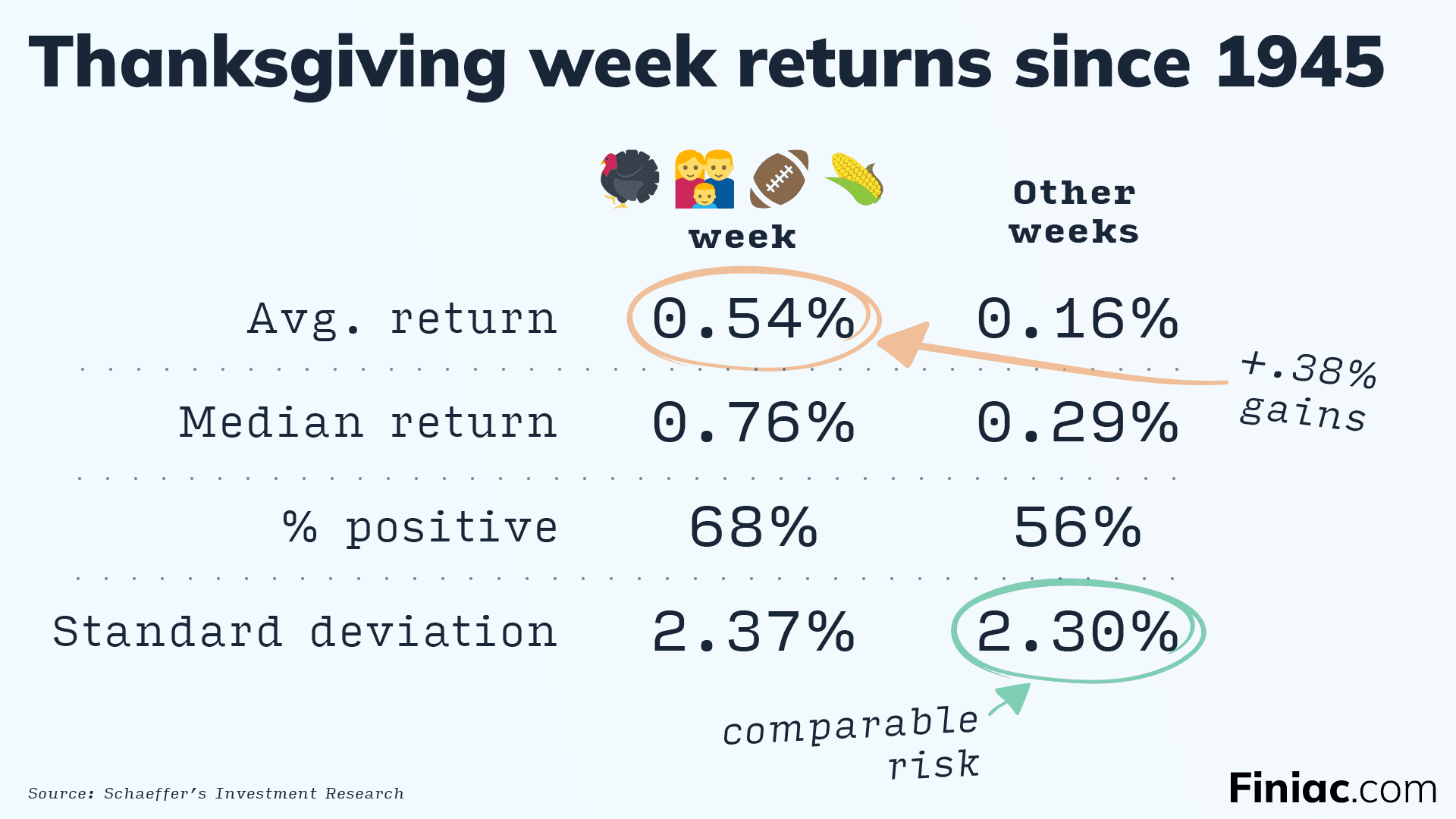

That’s what Buffett is all about. Look at Berkshire Hathaway’s annual performance, in comparison with the S&P500:

Graph showing the performance of Warren Buffett's Berkshire Hathaway compared to the S&P500 between 1965 and 2022.

There are some standout years, sure enough. But the thing they’re really good at—the thing that’s given them crazy long-term success—is beating market downturns.

Look closely. There’s barely a year in the last 50+ when Berkshire did worse than a sagging market.

Adopting Diversification Score as a guide, even just that one decision, is the kind of step that points you in the right direction. Mistakes and bad luck be damned.

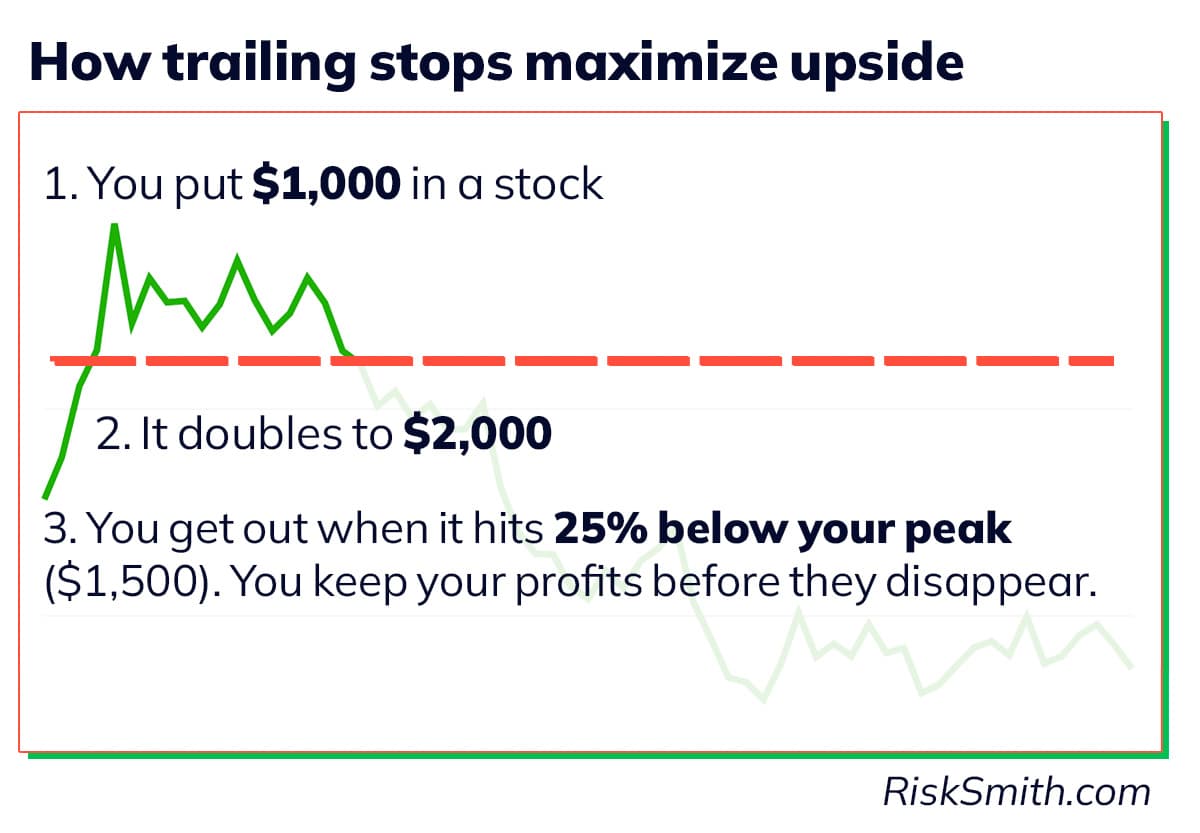

Don't fall prey to loss aversion

Design better portfolios with RiskSmith

Related Posts